VERY IMPORTANT NOTICE

THE EXISTING GOVERNMENT GRANT SCHEMES ARE COMING TO AN END.

Chancellor Rachel Reeves announced the partial removal of green levies from household energy bills in her Autumn Budget speech on November 26, 2025. This will take effect from 6th April 2026. The green levy is the vehicle that funds the ECO and GBIS grant schemes.

However, because of the time that it takes to carryout surveys, install the work and installers to receive funds, no new applications will be accepted after 24th February. This applies to ECO4 and The Great British Insulation Scheme (GBIS).

We do not know what, if anything, will replace the existing scheme.

Ed Miliband’s (Secretary of State for Energy Security and Net Zero) flagship energy efficiency policy, which has seen its total investment increased to nearly £15 billion. Exact details have not yet been announced. We should hear more in February 2026. This is what we know so far:

- Solar & Heat Pump Grants: The government is set to allocate roughly £13 billion over the next four years for new grants specifically for solar panels, battery storage, and heat pumps.

- Targeted Support: While official eligibility details are still being finalised, the scheme aims to help millions of homeowners, with the most significant assistance for upfront costs directed toward lower-income households and social housing.

- Low-Cost Loans: In addition to direct grants, a new system of low-cost loans is expected to be launched, allowing homeowners to install green technology with no upfront costs and repaying through their energy bills over 5–10 years.

- Heat Pump Grant Extension: The existing £7,500 grants for heat pump installations will remain in place at least until the next general election.

If you are interested in having Solar Panels and an Air Source Heat Pump, please complete our enquiry form and choose the Solar Panels & Heat Pump option.

However, there is still plenty of time for yet another U-turn – watch this space.

Welcome to Free Cavity Wall Insulation in Wales.

Free Cavity Wall Insulation throughout Wales!

Almost everyone qualifies, and for nearly everyone it will be free.

You do not need to receive benefits and there are no income thresholds.

Welcome to the Great British Insulation Scheme.

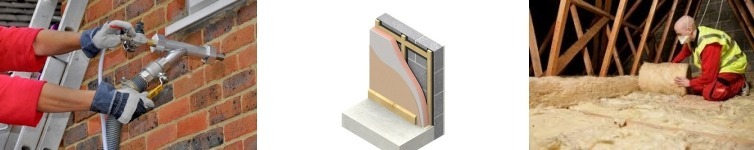

The Great British Insulation Scheme is a single insulation measure grant scheme. The available measures are listed below.

- Free Cavity Wall Insulation – This will always be free!

- Loft Insulation – Available in smaller lofts (there is an ongoing consultation to add loft with cavity wall insulation)

- Internal Wall Insulation – Available for terraced houses, small semi-detached homes and bungalows.

How do you qualify for a Great British Insulation Scheme grant in Wales?

There are 2 routes to qualifying for a Great British Insulation grant.

- The General Group.

- The “low-income” Group.

The General Group qualification for a Great British Insulation Scheme grant in Wales.

You need to say Yes to the following 2 questions to qualify.

- Is your Council Tax Banding in Wales an A, B, C, D or E (or in England A to D)? If you don’t know, you can find your Council Tax Banding on Gov.Uk, and

- Is your EPC (Energy Performance Certificate) rating a D, E, F or G.? You can find your EPC on the EPC Register. Don’t worry if your property doesn’t have an EPC – we can take care of that.

2 yeses and you qualify.

These rules apply to both owner-occupiers and privately renting tenants.

However, the Government have decided that if you are a privately renting tenant and you want cavity wall insulation or loft insulation you will need to receive a qualifying benefit. You will not require a qualifying benefit if you want Internal Wall Insulation.

The “Low Income” Group qualification for a Great British Insulation Scheme grant.

The personal qualification criteria for the “low income” group is that you are in receipt of a qualifying Government Benefit. Your EPC (Energy Performance Certificate) must still be a D, E, F or G rating.

This is a list of the qualifying benefits.

- Pension Credit

- Income-Based Job Seekers Allowance

- Universal Credit – No income threshold

- Income-Related Employment and Support Allowance

- Tax Credits (including Working Tax Credits)

- Income Support

- Housing Benefit – NEW

- Child Benefit/Family Allowance. Income Thresholds apply. See the table below. The incomes in the table are “gross incomes” – before deductions

| Number of children | 1 | 2 | 3 | 4 |

| 1 adult household | £19,900 | £24,800 | £29,600 | £34,500 |

| 2 adult household | £27,500 | £32,300 | £37,200 | £42,000 |

or call us on 07960 799 681 or 0800 8 10 10 60

It’s as simple as ABC

A- APPLY – complete an enquiry form

B – BOOK – a free no obligation survey

C – CARRY OUT the fully guaranteed work

Then sit back and enjoy a warmer home with smaller fuel bills and a smaller carbon footprint!